The truth about interest rates and financing. The headlines surrounding interest rates and financing can be scary…but, thankfully, the truth is much less so. Yes, interest rates are higher than they have been over the past few years. But, historically speaking, they’re still relatively low. And, the reality is, if you’re looking for a commercial or industrial property for …

Property Improvements: Are You Missing an Opportunity for Potential Tax Savings?

Property Improvements: Are You Missing an Opportunity for Potential Tax Savings?

By Jack Matasosky

If property improvements are on your mind, you might want to check out this recent article by Mark Colvin. According to his recent article, “Don’t Miss the Potential Tax Savings on Property Improvements,” “businesses that have made recent improvements to their property may be eligible for tax savings.” A recent IRS ruling is the source of this article commentary clarifying when an expenditure qualifies as a deductible repair and when it should be treated as a capital expenditure. […Continue Reading the Full Article]

If property improvements are on your mind, you might want to check out this recent article by Mark Colvin. According to his recent article, “Don’t Miss the Potential Tax Savings on Property Improvements,” “businesses that have made recent improvements to their property may be eligible for tax savings.” A recent IRS ruling is the source of this article commentary clarifying when an expenditure qualifies as a deductible repair and when it should be treated as a capital expenditure. […Continue Reading the Full Article]

As with all tax related topics, please consult with a tax and/or accounting professional for advice on your unique business.

If you are considering property improvements for your business, please feel free to with any questions you may have.

{{cta(‘a783137d-3d9e-4401-98fb-1695e85a9889’)}}

MN Manufacturing Online Resource Available: Made in Minnesota

MN Manufacturing Industry – An Online Resource is Available!

MN Manufacturing Industry…there is an online resource available to you, and you may not be aware of this opportunity! APPRO Development and CERRON Commercial Properties are fortunate to work a lot with the manufacturing industry. So, when we come across relevant topics, we are eager to share.

MN Manufacturing Industry…there is an online resource available to you, and you may not be aware of this opportunity! APPRO Development and CERRON Commercial Properties are fortunate to work a lot with the manufacturing industry. So, when we come across relevant topics, we are eager to share.

Last Fall 2013, the Department of Employment and Economic Development (DEED) for the State of Minnesota created and released a database specific to the manufacturing industry: Made in Minnesota. There is no cost for participation in this database. It is simple, easy to use, and only takes a couple of minutes to enter your information – HERE. When you sign up, you will be joining 823 other companies (and growing) already registered in the database, according to the Small Business 101 blog post, “A Holiday Gift for Manufacturers that’s Made in Minnesota”. We were impressed by the information found here and the possible opportunities which could result from MN manufacturers working together.

On a local level, we attend the Manufacturers Appreciation Event, hosted by the City of Lakeville every fall, in our own backyard, occurring during our Minnesota statewide Manufacturers Week. Over the years, we have found that neighboring businesses had no idea what the other manufactured until being introduced to one another at this event. As a result, neighboring businesses were able to work with one another, resulting in benefits for each company.

By having this same information available on a large scale, and with the ease of an electronic database, Minnesota companies have a fantastic opportunity to work with one another, and to keep our manufacturing dollars close to home.

Just thought our friends in the manufacturing industry might want to know!

For more great tips and property solutions information, sign up for our monthly E-Newsletter.

MN Warehousing Tax – Part 1

MN Warehousing Tax – Part 1

MN Warehousing Tax– Part 1 is the first of two reports we are planning to bring to our readers regarding the new warehouse tax on the books for MN businesses. If you are involved in third party warehousing as a part of your business, we are sure you have heard the MN Warehousing Tax is due to go into effect on April 1st. It is actually one of three business to business (B2B) taxes to go into effect in 2014. This specific warehousing tax would impact businesses which provide third party warehousing services, as well as those businesses who utilize these third party services.

According to the MN Department of Revenue, “Starting April 1, 2014, business-related warehousing and storage services will be taxable in Minnesota. This means state sales and use tax is due when a business buys warehouse or storage services for its tangible personal property.” There are exceptions to this rule, which are dependent upon business use[1].

Come April 1st, Minnesota would be one of few if not the only state with a warehousing tax of this kind, which could ultimately put the businesses in our state at a distinct disadvantage. Some companies are already feeling the impact of this tax. According to an article by Jessica Harper for Sun Thisweek Dakota County Tribune, in an interview with warehousing General Manager, Kathy Forester, in talking about the tax, she states, “With its customers seeking services elsewhere, Strategic lost 18 percent of its revenue between August 2013 and January 2014, which prompted the company to lay off 22 percent of its workforce[2].”

The Minnesota Legislature is scheduled to reconvene on February 25th. At that time, the Minnesota State Budget will be reviewed. If there is a sufficient surplus, Governor Dayton may consider a repeal of one or more of these B2B taxes[3]. As it stands now, however, these taxes have been signed into law and only a new bill that strikes the provision of the current tax could repeal it. There are many groups working right now, toward the effort to repeal the MN Warehousing Tax.[4]

Stay tuned to learn more in the weeks to come, or feel free to contact our team with concerns about the impact on your current commercial space.

Upcoming Dates:

- Mid-February – State Budget Forecast (Gov. Dayton will use this information to determine if these new taxes are necessary)

- February 25th – New Legislative Session Begins

- April 1st – New Warehouse Tax goes into effect

[1] MN Department of Revenue Warehouse Tax Summary

http://www.revenue.state.mn.us/businesses/sut/Pages/2013_WarehouseStorageServices.aspx

[2] Businesses impacted by the MN Warehouse Tax

http://hometownsource.com/2014/01/27/businesses-legislators-feel-heat-from-new-taxes/

[3] Businesses vow to repeal the warehouse tax and Gov. Dayton to support repeal if sufficient surplus exists

http://www.mprnews.org/story/2014/01/08/businesses-vow-to-seek-repeal-of-warehouse-tax

[4] Commercial Real Estate Group works to repeal the tax

http://www.startribune.com/business/242830181.html

Manufacturing Trends to be Thankful For in MN

Manufacturing Trends

Manufacturing Trends to be Thankful For is an article we read this morning in the online publication of Industry Week. All of us, in MN or the Midwest for that matter, who are either in the manufacturing industry or have close ties to the manufacturing industry, are eager to see what the days of 2014 will bring. According to this article, “Favorable Forecast: Five Manufacturing Trends to Be Thankful For” by John Mills as published in Industry Week (online), 2014 might just prove to be year for which to be thankful!

According to the article, the following are the top five trends to watch this year:

- Improvements in 3-D printers

- Business returning from China

- More ‘real-time’ enterprises

- The rise of the project economy

- More access to data

As Mills states, “no one has perfect foresight” and it certainly would be nice if we did! However, in the meantime, by measuring trends and current data available, we are optimistic for our colleagues in the manufacturing industry. We hope 2014 results in the optimistic forecast, as it benefits not only MN, ND, WI, IA, SD, MT in the Midwest, but our great nation as well!

APPRO Development is a general contractor specializing in property solutions for manufacturers across the Midwest for more than 27 years. APPRO assists business owners find optimal property solutions that may result in renovations, expansions, additions or new commercial buildings to meet the ever changing needs of the manufacturing industry in Lakeville (55044), Apple Valley(55124), Burnsville(55337), Eagan(55123), Hastings(55033), and all of Dakota, Scott, Rice, Carver, Ramsey and Hennepin counties as well as Mankato and surrounding communities of Blue Earth in Minnesota. If your commercial or industrial space needs are changing as the result of a great 2014, contact our team today to help you minimize impacts to your manufacturing schedule, meet your budget requirements, and assist you in making 2014 a great year!

What to Look for in Investment Properties

Want to know what to look for in investment properties? This is a great place to start.

Love Real Estate? Thinking about getting into Investment Properties?

Love Real Estate? Thinking about getting into Investment Properties?

Most people know the common formula affectionately known as IRV.

Income = Rate X Value

Income is the net operating income (revenues minus operating expenses and before debt service).

Value is the real estate market value.

Rate is the capitalization rate. When you have a higher cap rate, the lower the value for the same amount of income or conversely, the lower the cap rate, the higher the value. Cap rate also reflects risk. Typically the higher the cap rate, the higher the risk. Lower cap rates come from credit tenants who are perceived as less risky. Cap rates run around 4% to 12% with an average of 8%. For easy figuring many use 10%–$100,000 of income is a $1 million value.

The other part of the equation is not reflected here: what does is cost to borrow. If interest rates remain low (as they are predicted to do), then the cost of borrowing will stay low and allow for greater property values that still provide a desirable rate of return. Some investors have recently enjoyed 5 year money for as little as 3% interest. When you can leverage your money, you can make more money, but it is also more risky. I suggest you talk to your banker before looking to buy to find out how much you could borrow and at what terms that work for you. If you don’t have a banker, we can provide several professional contacts we have enjoyed working with over the years.

Other things to look for:

- quality of the tenants

- length of the term of the leases in place and renewal terms

- vacancy (and vacancy allowance)

- quality of the building, grounds and parking lot

- condition of HVAC

- condition of the roof

- responsibilities of landlord/tenant in the lease

- property management

- operating expenses—are they in line?

- real estate taxes –property tax detail

- location –ease of access, lit intersection

- potential changes in roadways or development-contact the city

- zoning code and allowable uses

- potential reuse

- parking stalls—parking ratio

- visibility

- signage

The good news is that anyone can be a real estate investor. The key is to have good people to help you with your property: banker, property manager, commercial real estate agent, contractor, accountant and real estate attorney. The APPRO/CERRON team can help with leases, sales, acquisitions, management, market/proforma analysis, architectural design, and construction. We have contacts to cover the other areas to fit your project. Take their professional advice, use common sense and follow the golden rule of real estate: don’t fall in love with it. When it is time to sell, sell.

<em>The information contained on this website and from any communication related to this website is for information purposes only. As with all financial matters, consult your tax, legal or accounting professionals to discuss how investment decisions may impact your specific circumstances.</em>

Commercial Property Tips: 13 Spooktacular Ideas for Non-Creepy Spaces

13 Commercial Property Tips for Non-Creepy Spaces

Our team would like to share some fun commercial property solution ideas to keep your space from being creepy (BEWARE: this blog post contains many links to helpful resources – you may need to hover your cursor over to see the link and a description will “magically” appear – only a little spooky, right!?):

- Clear out the spiders and cobwebs to make your space enchanting. We team up with the best subcontractors in the industry, including commercial cleaners & landscapers.

- If your parking lot is looking more like a graveyard, than a welcome space for your employees and visitors, it might be time to consider an exterior update. We hire the best Project Managers in the Midwest who oversee our remodel, expansion and new building projects.

- If your employees are looking more and more like zombies because their workspace needs changing, you may want to consider a possible remodel. Our design team can plan out ideal space configurations for your workplace.

- If you encounter monsters on your drive into work, you may want to consider moving your business to a different location. CERRON Commercial Properties – our website includes ALL Minnesota commercial properties*!

- Does the thought of finding a new space feel a little scary? A new lease space is waiting for you.

- Afraid of the Dark? Shed some light on your office, retail or industrial spaces by implementing new lighting and/or design options. Our award-winning Architect has the perfect solution.

- Are ghosts and tumbleweeds the only things passing by your retail space for lease or sale? The CERRON team can connect you with some live prospects.

- Wondering if it is time to sell your space, but the cat’s got your tongue. Get a quick, easy, and free market analysis.

- Do you find the prospect of financing a new project downright hair-raising? Clear, solid financing options are available.

- Face the skeletons in the closet and tackle building maintenance. Use our annual maintenance checklist.

- Looking for the perfect potion for configuring space or calculating financing? Easy estimating tools (space & mortgage calculators) are bubbling up in our cauldron.

- Are your employees howling for more space? APPRO can fast track a new building for your favorite werewolves.

- Finding vampires everywhere you go? Might be time to consider working with our friendly, (non-blood-thirsty) APPRO and CERRON team.

Wishing you and your team a very Happy Halloween!

“Orange” you going to consider sharing this? We sure would love it if you did!

Why It Pays to Be Likeable in MN

Why It Pays to Be Likeable in MN

After having adopted more social media into the marketing of our South Metro, MN, design build and commercial real estate businesses at both APPRO and CERRON, we understand more, the importance of “Why it Pays to be Likeable.” So, when we came across this article written by Dave Kerpen on the NFIB website, we knew we needed to share it with our blog readers. “In a world of ‘Likes,’ it pays for a business to be likeable – friendly, approachable, understood – not just in the traditional sense but also in social media.”

After having adopted more social media into the marketing of our South Metro, MN, design build and commercial real estate businesses at both APPRO and CERRON, we understand more, the importance of “Why it Pays to be Likeable.” So, when we came across this article written by Dave Kerpen on the NFIB website, we knew we needed to share it with our blog readers. “In a world of ‘Likes,’ it pays for a business to be likeable – friendly, approachable, understood – not just in the traditional sense but also in social media.”

Dave Kerpen, the CEO of Likeable Local, a social media software startup for small businesses, conducted a recent webinar for the NFIB in which he “showed how businesses are achieving amazing results with creative social business strategies, exploring what today’s consumers expect from organizations and ways you can exceed customer expectations.”

Dave explains the 7 key ways to be more likeable, which include:

1. Listen.

2. Respond.

3. Tell, don’t sell.

4. Be authentic.

5. Advertise – better.

6. Provide value.

7. Be grateful.

You may read the full article and more details on each of these 7 ways for you and your company to learn Kerpen’s philosophy on why it pays to be likeable by following this LINK.

APPRO and CERRON have been working for more than 25 years to be not just “likeable,” but truly authentic in our approach to create unique property solutions for each of clients to whom we are sincerely grateful for the opportunity to serve. Learn what makes us unique and the services we offer, by visiting our Services page. Please feel free to contact us any time – until then, we will be busy Creating Property Solutions For You…With You!

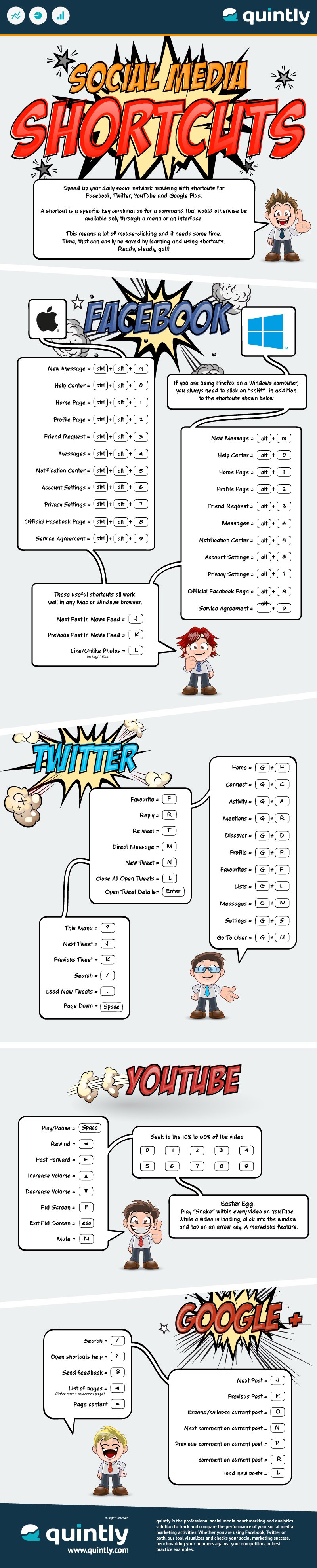

Social Media – Tips, Tricks, and Shortcuts

Social media – tips, tricks, and shortcuts are on the brain this week at APPRO and CERRON. Why? Well, we made the commitment this past year to dig in more deeply to the utilization of social media to begin or continue discussions with our friends and clients, in addition to finding out what is important to each of their businesses. And, why not? It is growing in use due to an increase in mobile device usage and an adoption of use by the older segment of our population, according to a recent article by Jeff Bullas for Small Business on Yahoo!, titled, “21 Awesome Social Media Facts, Figures and Statistics for 2013.”

According to Bullas, here are some very interesting facts about the adoption and growth of social media:

- Mobile – with the number of people accessing the Internet via a mobile phone increasing by 60.3% to 818.4 million in the last 2 years.

- Older users adoption – On Twitter the 55-64 year age bracket is the fastest growing demographic at 79% since 2012. The fastest growing demographic on Facebook’s and Google+’s networks are the 45 to 54 year age bracket at 46% and 56% respectively.

In addition, we wanted to share some basic stats for each of the social media outlets we found fascinating (again thanks to Jeff Bullas (who can be followed on @jeffbullas on Twitter) for sharing these stats):

- Facebook: Monthly active users have passed 1.1 billion for the first time

- Twitter: 288 million monthly active users

- YouTube: 1 billion unique monthly visitors

- Google+: 359 million monthly active users according to a Global Web Index study

- LinkedIn: Over 200 million users

We were fascinated by these stats and consider ourselves relative novices in the use social media. So, maybe like you, if you have jumped on and are in the midst of “liking”, “tweeting”, and “sharing” but, find it all takes a whole lot of time in your day (you didn’t really have to spare), we would like to share some time saving shortcuts with you. We came across this great social media shortcut infographic article on Quintly, by Aljoscha Fermor we wanted to share with our readers.

If you have not already connected with us on our social media sites – go ahead and click on the links at the top of our web page, or right here: We look forward to connecting with you to bring you property solutions as we continue to work for you…with you!

Property Improvements: Are You Missing an Opportunity for Potential Tax Savings?

If property improvements are on your mind, you might want to check out this recent article by Mark Colvin. According to his recent article, “Don’t Miss the Potential Tax Savings on Property Improvements,” “businesses that have made recent improvements to their property may be eligible for tax savings.” A recent IRS ruling is the source of this article commentary clarifying when an expenditure qualifies as a deductible repair and when it should be treated as a capital expenditure. […Continue Reading the Full Article]

As with all tax related topics, please consult with a tax and/or accounting professional for advice on your unique business.